Lively Vs Passive Mutual Funds: Know Which Is A Greater Investment Guess And For Whom

So, investors need to pay much less taxes since capital achieve distributions are generally taxable. There is also much less want for in depth research, evaluation, evaluation, and trading, leading to decreased costs. Moreover, investors do not decide shares in passive investing, which implies that oversight is much cheaper. If the chosen investments underperform, the entire portfolio could suffer drastic losses. Also, if various surprising events occur available in the market, corresponding to financial downturn and sure forms of stocks performing poorly, the portfolio becomes extra susceptible to crashes since it’s not a diversified one. In contrast, if investors generate a diversified portfolio, they are more more likely to stand up to extreme market conditions as a end result of the losses in a single area could also be balanced by gains in one other.

- Since passive funds solely purpose to duplicate the efficiency of a benchmark index as a substitute of outperforming it, the extent of management required is minimal.

- This may contain more threat and volatility than passive investing as a outcome of the manager is actively pursuing higher returns.

- In such cases, investors should give significance to regularly revising their asset allocation over the lengthy term.

- An investment calculator may give you an estimate of the returns you may anticipate with completely different kinds of funds.

Active funds are inclined to have a higher stage of threat because the flip aspect of outperformance is underperformance, and which way the fund goes is determined by the choices taken by the fund supervisor. As for passive funds, the primary danger they face is what’s known as the tracking error, which is the deviation of the fund’s performance from the benchmark index. Actively managed funds are enticing to buyers who search larger returns than the market and wish to profit from the experience and research of the fund supervisor. Active funds may also present higher capital protection in turbulent markets by adjusting the portfolio accordingly.

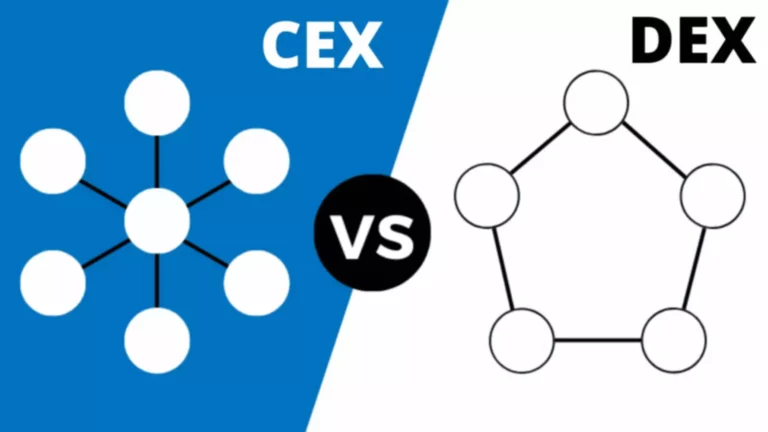

Distinction Between Lively Vs Passive Investing

Even if one have been to see, US was a comparatively excessive development economy from 1970s-90s; sustainable healthy development on a large base gave the opportunity for new sectors to emerge and grow. Despite the energy disaster in 1979, Vietnam struggle ( ), Black Monday in 1987 and a lot of different such events – a larger proportion of energetic fund managers outperformed the benchmark. Exchange-Traded Funds (ETFs) can be bought and bought like any other stock on the exchange throughout market hours at real-time costs.

Passively managed funds are probably to comply with the weighting methodology of the benchmark index, which can not always be aligned with an investor’s threat tolerance and preferences. For instance, most market indices observe market-cap weighting methodology, which leads to a few giant corporations having a big impact on the index’s performance. Passive funds are typically more tax-efficient as they’ve a lower turnover and tend to have fewer capital features distributions.

The relative efficiency of lively and passive funds can be influenced by market conditions. In intervals of high market volatility or when stock correlations are low, active managers may have more alternatives to add value by way of inventory choice and tactical asset allocation. Conversely, during periods of low volatility or excessive correlations, passive funds may outperform because of their low prices and broad exposure. Active investing entails more frequent trading, which ultimately results in extra transaction costs, including brokerage charges and taxes. Contrary to beating the general market, passive investing primarily goals to match or replicate the efficiency of a group of assets or a particular market index. Instead of actively buying and promoting stocks or bonds, passive investors put money into exchange-traded funds (ETFs) or index funds.

2 Costs

For instance, the typical expense ratio of actively managed fairness funds within the US is around zero.68%, while that of passively managed funds is zero.06%. This massive difference in expense ratios of active funds and passive funds could be seen in India as properly. Actively managed funds goal to beat the market and offer returns to traders that are larger than the market common.

This occurs as a outcome of passive investing does not give any regard to trade tailwind, administration high quality, progress opportunities, balance sheet metrics and other such elementary features of investing. While passive funds have labored well in a mature economic system, that may not be the case universally. We strongly disagree that passive investing is better than lively investing and bring a differentiated perspective to the idea of passive investing. In addition, most of these funds hold onto investments for a very lengthy time, which reduces the potential for selling them for trading functions. Since fewer capital features are achieved within the fund, fewer income are distributed to the investors.

The price of lively administration usually hinders many energetic managers from outperforming the index as quickly as bills are thought-about. Consequently, passive investing has emerged as a most popular choice as a result of its decrease fees. However, the choice between active and passive investing also hinges on the level of danger one is willing to assume. While some active funds have outperformed the benchmark, they usually entail greater dangers. Ultimately, the selection is dependent upon your threat profile and investment type.It is essential to conduct thorough analysis and seek the guidance of with a professional financial advisor before making any vital investment selections. Active mutual funds typically have larger prices and charges than passive funds because they require more experience and analysis by the portfolio manager.

Energetic Vs Passive Mutual Funds: Which Is A Better Investment Guess And For Whom

Active funds aim to outperform the market, so the fund manager invests in specific securities they consider will produce the highest returns. This could contain more threat and volatility than passive investing because the supervisor is actively pursuing higher returns. Passive funds, on the other hand, try to duplicate the performance of a particular market index, in order that they put money into all or a representative pattern of the securities included in that index. This ends in much less risk and volatility in comparison with lively funds as a outcome of they do not seem to be trying to beat the market. Ultimately, the decision between passive funds vs energetic funds depends on an investor’s distinctive financial situation, targets, and funding philosophy. Active investing provides the potential for larger returns and adaptability, while passive investing supplies a cheap, lower-risk technique with consistent market returns.

They do not undertake energetic inventory selecting or asset allocation, because the portfolio is constructed to replicate the chosen index. For instance, an S&P 500 index fund would come with all of the stocks that the S&P 500 market index holds (with the quantities of the stocks potentially being decided using a criterion corresponding to market cap). Hence, the first duty of the supervisor of a passively managed fund is to make certain that it closely tracks and replicates the efficiency of the benchmark index. One of the first causes to opt for actively managed funds is their potential for outperformance.

Trust In Passive, Relaxation Must Deliver Data: Funding Mantra For Better Returns

When it involves investing in mutual funds, people get confused as to whether they spend money on an lively or a passive fund. Proponents of each energetic and passive may have their arguments to draw buyers, but experts counsel having an allocation in both funds. Passively managed portfolios observe a unique philosophy from energetic management. In this strategy, the funding strategy is to reflect a specific market index’s efficiency, rather than attempting to outperform it. Passive investments embrace autos such as index funds, exchange-traded funds (ETFs), and some funds of funds. As an active investor you wished to compensate for the higher fees that you simply pay and likewise for the higher threat that you simply take.

Moreover, when a portfolio is rebalanced, i.e., introduced again to its asset allocation, it could cause a tracking error. This occurs as a outcome of rebalancing requires the shopping for and promoting of securities to make an ideal combine. If the investor does not do that at the right time or frequency, the portfolio might not match the index or benchmark properly.

What Is The Difference Between Lively And Passive Investing?

Massive wealth creation has occurred across each these sectors; particular stocks have delivered multi-bagger returns. Passive investing is a technique of investing in funds that observe a market index, such as Nifty or Sensex, and goal to ship returns just like the index. Also, one should do not neglect that investing in the market, particularly in equities, is fraught with danger https://www.xcritical.in/. However, one could minimise this risk and maximise their returns by being careful with choosing the acceptable funds, utilizing the investment calculator, and following the advice of consultants. To help you choose the appropriate possibility, we have in contrast lively investing vs passive investing.

The investment may be carried out with the aim to surpass the benchmark returns of the index in which the selected stocks are listed. In contrast to this, an energetic fund employs a fund manager to attempt to outperform the index return. So, if an energetic fund doesn’t generate a return higher than this, it will not beat the passive fund’s return. Despite this handicap, many opine that lively funds would nonetheless beat passive funds in the lengthy run.

Passive investing, then again, adopts a more hands-off method, usually implementing a “buy and hold” strategy with minimal energetic management. In conclusion, both energetic and passive investing play a big function in managing investments. Active management tries to beat the market to make extra cash, while passive administration goals to match the market’s performance by following a specific index. Since passive investments usually monitor broad market indices (which embrace a broad range of stocks, bonds, or other securities), they’re usually larger in diversification. As passive traders are uncovered to varied property inside a single investment, they face fewer dangers from stocks that don’t perform nicely.

This outperformance, as discussed earlier, is the first aim of active traders who handle their portfolios in a fashion to generate larger returns. Each strategy comes with its own set of distinctive options, advantages, and downsides, and deciding between the two can be highly confusing, particularly for brand spanking new investors. Therefore, a transparent understanding of the differences between energetic and passive investing is crucial for investors to make informed choices.